How Overseas Pakistanis can become tax filer?

Many Pakistani National living in foreign countries may have a question arising in their mind that how overseas Pakistanis can become filer. You can find your answer here: Do Overseas Pakistanis Have to File Taxes? Yes, overseas Pakistanis can become filer and every foreign Pakistani has to pay their taxes based on their income in […]

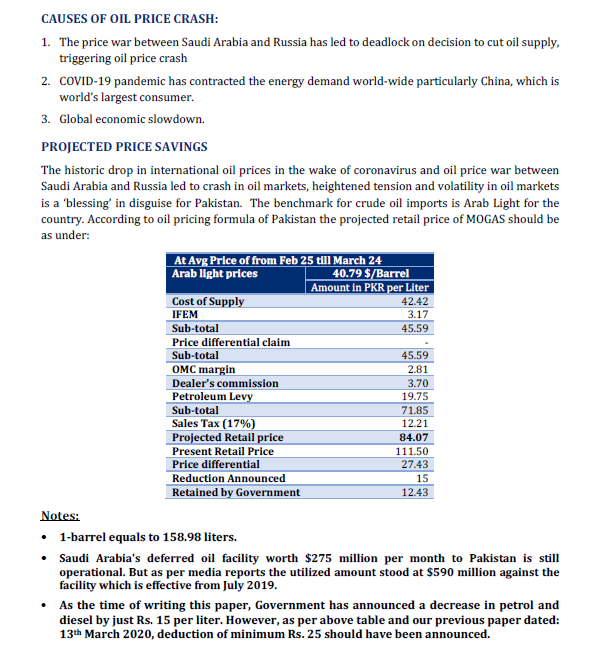

Impact on retail petroleum prices of global oil crash

Also Check:How to become a FilerHow to check FBR Filer StatusWho is filer and non-filer?

How to become a Filer in Pakistan?

If you are the citizen of Pakistan, it is your duty to pay your tax. To become a filer in Pakistan, you must have a sim card registered with your own Cnic number, your personal email address, pdf file of Certificate of maintenance of your personal bank account, Evidence of Tenancy/Ownership of business premises in […]