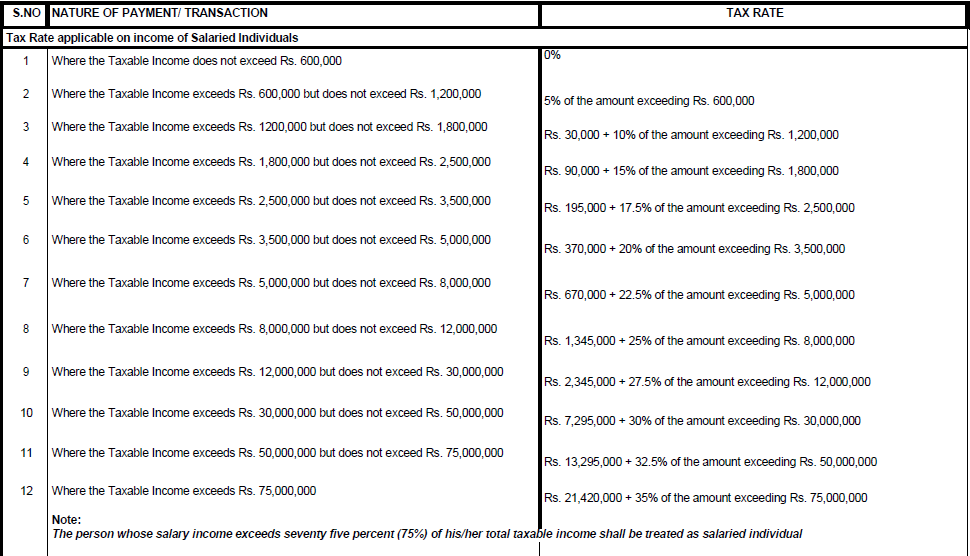

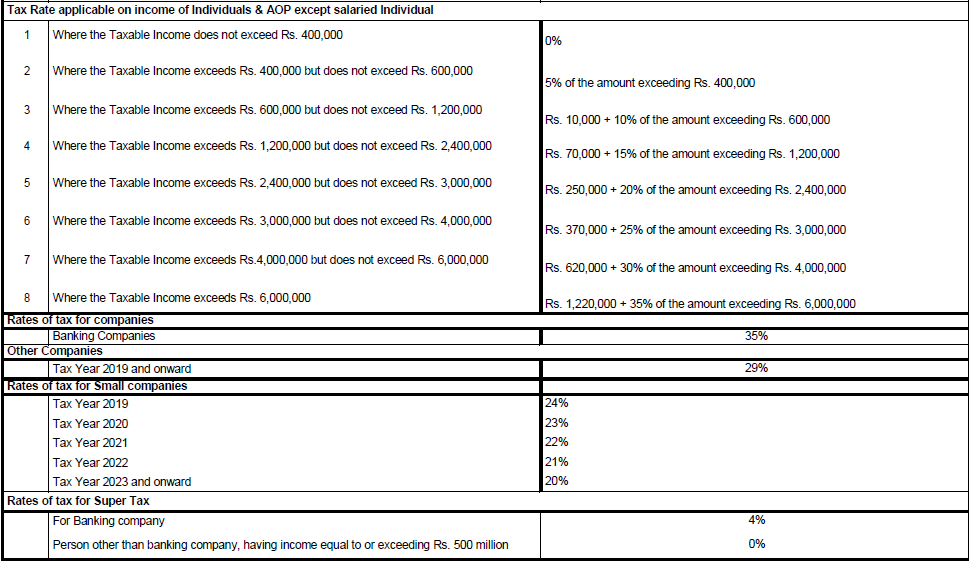

Here are the income tax rates in Pakistan for year 2022-21

Also Read: What is withholding tax

Important Note:

Please note as for these income tax rates in Pakistan where a persons is not appearing in the active taxpayers’ list, the rate of tax required to be deducted or collected, as the case may be, shall be increased by hundred percent of the rate specified to be deducted or collected. However, these provisions shall not apply on tax collectible or deductible in case of the following sections.

- Tax deducted under section 149

- Tax deducted under section 152 other than sub-section (1), (1AA), (2), (2A)(b) and (2A)(c) of section 152

- Tax collected or deducted under section 154

- Tax deducted under section 156B

- Tax deducted under section 155

- Tax deducted under section 231A

- Tax deducted under section 231AA

- Tax collected under section 233AA

- Tax deducted under section 235

- Tax deducted under section 235A

- Tax collected under section 235B

- Tax collected under section 236

- Tax collected under section 236B

- Tax collected under section 236D

- Tax collected under section 236F

- Tax collected under section 236I

- Tax collected under section 236J

- Tax collected under section 236L

- Tax collected under section 236P

- Tax collected under section 236Q

- Tax collected under section 236R

- Tax collected under section 236U

- Tax collected under section 236V

- Tax collected under section 236X

12 Responses

A S A

Dear SIR/ Madam

I am ruing PROPERTY EASTATE in Karachi ut, Yearly Income is not very High.

Therefore, I still need N T N Number in vitreous form to fill out like visa an application ect, ect.

Please Guide me how to I can have my N T N No.

My CNIC No. is: 4210187083435

I wait for your response in due course.

REGARDS.

SOHAIL AHMED

You are requested to please send us CNIC snap, rent agreement or any proof of ownership of business premises and current paid electricity bill of business premises and also provide us your own biometric contact number. Upon, filing the case, NTN will be uploaded in an hour.

My only taxable income is pension benefit account and behbood certificates issued by national savings centre. The income is Rs 1478000. May I know the amount of tax payable. I am a pensioner 76 years old.

Sir your pension amount is exempt while the profit on certificate is tax chargeable rates on profit is 10% upto Rupees 5 lac while it is 15% exceeding 5 lac Rupees Note The tax rates will be doubled in case if The Person is Non Filer

Thanks for your reply. Is pension benefit account also exempt. I know pension is exempt but this is pension benefit account opened with national saving centre my tax advisor says income from pension benefit account is taxable.Kindly May I have your views on this.

Still waiting for response. Question is is income from PBA taxable or not.

Sir I am purchased ceiling fans from a shop of Rs.44000/- Kindly guide me what rate deduction of income tax or both sales tax. How much amount I should deposit to income tax head

Income tax is applicable on this purchase and it will be deducted from Retailer end, not from the consumer end.

can you please tell me about the taxation rate of T-bills pakistan FOr year 2020-2021

In the case of telephone subscribers, 10% of the (other than mobile phone) exceeding where the amount of monthly bill amount of bill and In case of internet, 12.5% of the amount of monthly bill.

assalam o alikum..

sir my salary is 150,000

and i am non filer

but i receive only 80,000.

is that tax cut..?

Your monthly tax is 7000 then it must not be your tax cut.